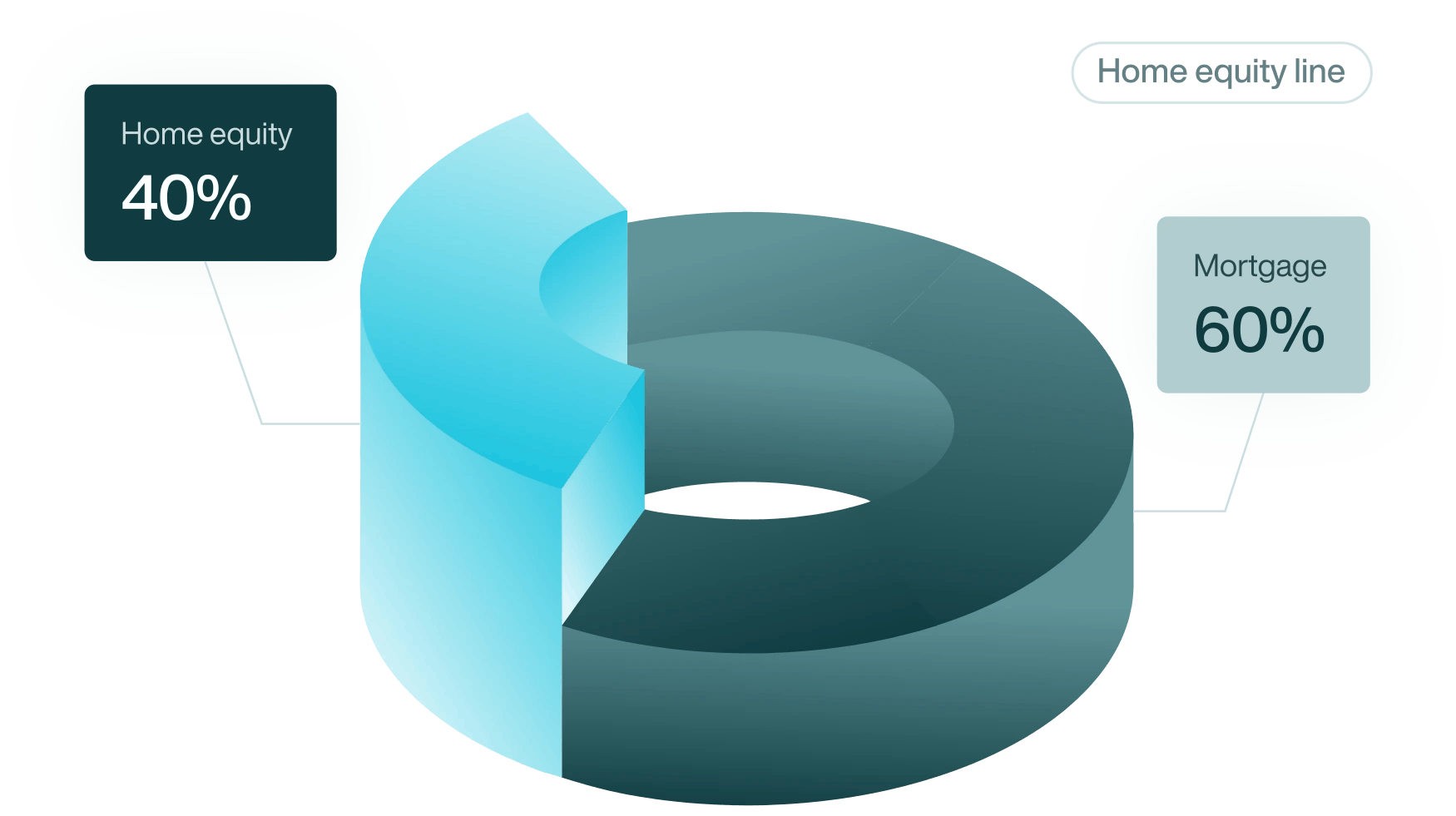

Access the leading non-bank home equity lines of credit in the U.S.

Access up to 90% of your property's value

You can get up to a $400,000 line of credit. You don't have to use it all at once and you'll only pay interest on what you withdraw.

Lowest rates, maximum savings

Easier approvals and longer repayment terms

A HELOC offers greater borrowing flexibility with terms up to 30 years compared to credit cards or traditional personal loans.

Terms up to 30 years

Lower rates mean more savings

A HELOC can help homeowners save thousands of dollars in interest payments compared to a cash-out refinance.

Best-in-class interest rates